Outline

- What is a URA and a TIF, and how do they work?

- Will my taxes go up, or will money be taken from existing budgets like schools?

- What benefits does the community get?

- Why is a URA needed for this development?

- Criticisms of URAs and TIF.

- Best Practices – if we’re going to do this, let’s do it right.

What is a URA and TIF, and how do they work?

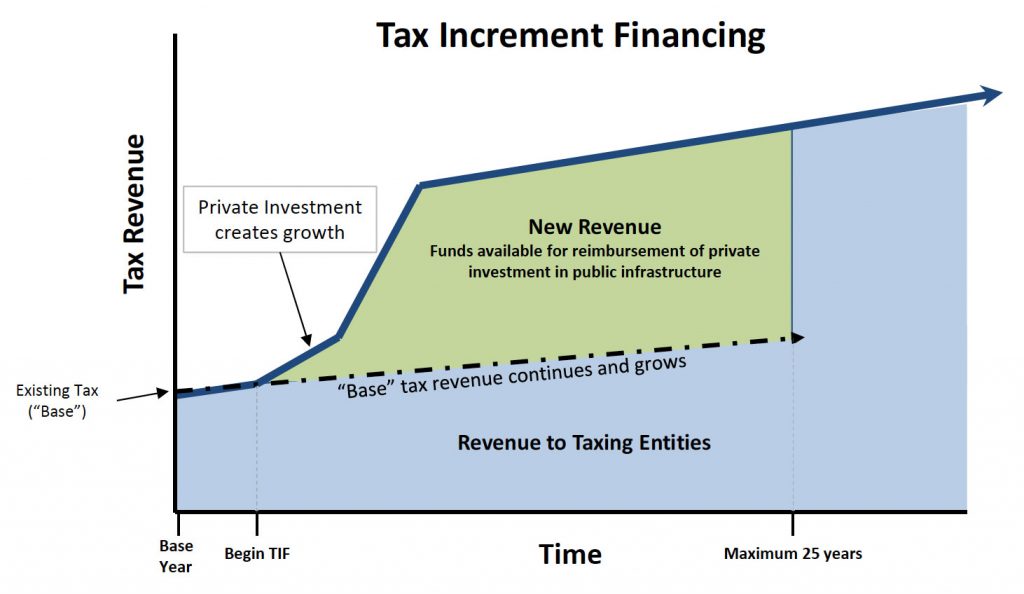

An Urban Renewal Authority (URA) is a form of tax increment financing (TIF), which is a success-based reimbursement program – here the developer pays for all project development costs, including public infrastructure usually paid for by a town, and only if the project creates new revenues for the community can the developer be reimbursed for eligible costs from the new tax revenues generated by the project. There are no new taxes on the community. Once the eligible costs are reimbursed, or after 25 years (whichever occurs sooner), all newly created tax revenue flows to the Taxing Bodies (Town, County, school district, etc.).

TIFs are the concept success-based programs and a URA is a specific type of TIF program used in Colorado. The terms are often interchangeable.

See URA Brief from Colorado Legislative Council Staff HERE

More info from Downtown Colorado Inc about URA and TIF HERE

Does TIF mean my taxes are going up? Is TIF a New Tax?

No new taxes are created by TIF or a URA, and NO existing taxes are increased. By definition, TIF is the “increment”, or the new amount of tax paid exclusively on the development property, and by the developer and new businesses within the project. The revenues produced by increased property tax values and increased sales activity within an urban renewal area are used to reimburse eligible costs in the urban renewal area. TIF is a new source of tax revenue, not an additional tax. The new revenue would not be available but for the private investment by the developers.

- No money is paid by the Taxing Bodies to develop the property.

- There are no new taxes imposed on any residents in the community.

- No existing taxes can used toward the project.

- The Taxing Bodies have no financial risk associated with the development or the URA. The developer bears all the risk. If the project is not successful, the taxing bodies, including the Town, have no obligations and the developer is simply not reimbursed.

- URA funds cannot be used toward developer profit or the development of privately-owned buildings. They can only be used for certified Eligible Costs as defined by state law, which include public infrastructure such as roads, utilities, and public spaces.

What Can TIF Funds Be Used For?

TIF revenues in a URA may only be used for improvements that have a public benefit and that support stated redevelopment efforts, such as: site clearance; construction of streets, utilities, parks; removal of hazardous materials or conditions; and construction of public facilities.

Does the use of TIF pose any risk to the finances of the Town, County or School Districts?

No. The Town, County and other taxing entities (school district, fire department, etc.) have no financial obligations related to the URA, nor are any existing tax dollars used toward the project.

Specific to the School District, the proposed URA would result in no loss of revenue to the school, the School District would receive full funding for any any new students created by the development project, and 100% of new taxes created and paid by the development toward the Mill Levy Override would go directly to the school district. This approach ensures that the School District is a huge beneficiary of the any new growth created by the project.

What happens if the proposed development isn’t successful? What’s the worst-case?

Nothing. The developer bears the development risk, so if the project isn’t successful the community still gets the public infrastructure that the developer pays for. Because no existing tax dollars can be used toward the project, and because the project won’t go forward without a URA, the worst-case scenario if the project fails is that the community gets exactly what it already has.

However, if the URA is created and the project moves forward, then all benefits to the community and gains to the taxing bodies are the up-side that would not have happened otherwise.

Benefits to the Community

Advancing Community Goals

In the 2018 Town Comprehensive Plan [View HERE], created and adopted by Town Council, the Town established the goal of developing the 27 acres adjacent to the Springs Resort and specifically defined it as a ‘Catalytic Project that exemplifies the goals and actions contained in the comprehensive plan’. The Town also specifically called for the use of Tax Increment Financing (TIF) as the funding pathway that should be used to accomplish the project. A URA is a type of TIF program. In addition, the proposed development matches the planning and zoning goals and requirements established by the Town. The proposed project will include:

- A Town Plaza – concerts, festivals, dining and shops

- Event Space – conferences, meetings, banquets

- Walk-ability – pedestrian paths connecting to main street and exiting trails system

- Mixed-Use Development – housing, hotel, retail, office

- Eco-Friendly Design – habitat conservation, low-energy design

Fiscal Impact

The project is expected to create roughly 700 jobs and approximately $10 million in new revenue to the Town and $10 million in new revenue to the County during the Urban Renewal Period. Once the developer is reimbursed for Eligible Costs, or after 25 years, whichever happens sooner, the taxing bodies receive 100% of the newly created tax revenue. After Eligible Costs are reimbursed, new tax revenue of $3.3 million per year are expected to be paid to the Town, and $2.5 million per year to the County. The taxing entities can use all these new revenues in any way they choose, such as for workforce housing and other community goals.

Why is a URA needed for this development in Pagosa?

Quite simply, without a URA the project is not financially feasible. There is a lack of critical public infrastructure available at the project site – roads, utilities, public spaces. In most other urban settings this core infrastructure exists already and therefore a new development only has to pay for the cost of the buildings themselves. When the cost of constructing the needed public infrastructure is combined with the cost of developing the rest of the project according to Town planning and building requirements, the total project costs are far too high for the project to move forward. Further evidence of this insurmountable issue is that fact that this land has remained undeveloped for over 100 years while it sits in the middle of Town.

The proposed project will not happen unless the URA is approved.

Why should this project get a URA when others in the past have not?

TIF and URA programs have been in existence in Colorado since the 1950’s. Any qualifying project can pursue the use of a URA. The primary factors that make URA projects successful are 1) they accomplish community growth and development goals, and 2) they have a positive economic impact on the community. It’s impossible to know why past developers have not utilized these programs on other projects, but perhaps they didn’t accomplish Town goals or weren’t as beneficial to the community.

Criticisms of URA and TIF

As with any finance or tax related program there will always be criticisms and examples of when such programs have not worked. There is also no doubt that TIF programs have been abused at times. So, what will make this proposed URA a good thing for Pagosa? Below are some criticisms relating to past TIF projects, along with descriptions relating to the specific Pagosa URA project being considered. By addressing issues in advance and working collaboratively with the community, Pagosa Springs can ensure its URA is successful in achieving community goals.

- TIF is a “giveaway” of tax dollars and puts money in the developer’s pockets.

- False. First, and as established by state law, no existing tax dollars can go toward the development of the project. Second, no future tax dollars paid anywhere else in the community go to the development of the project. Only those taxes paid by the developer and on the development property can be used to reimburse the developer for eligible costs, such as roads, utilities and public spaces. Finally, the reimbursement funds can’t be used for profit or private development.

- The money that some describe as “our tax dollars going to private developers” doesn’t exist. It will only be created IF the developer builds the project AND only comes from taxes paid by the developer and on the property being developed. There is no new tax on anyone in the community. This is why experts describe TIF as “A success-driven tool”. The developer pays for public infrastructure, takes all the risk, and is only reimbursed for that public infrastructure if they generate new taxes from their development.

- Special Taxing Districts aren’t represented and lose money.

- Wrong. First, as described above no taxing entity gives any of their existing revenue toward the development of the project. Also, under Colorado state law, the URA representatives and the developer must meet with each special taxing district (school, fire, hospital, etc.) to discuss the economic impacts of the proposed project on each taxing entity. Alos, learning from past experiences with TIF/URA projects, the state of Colorado updated the law in 2015-2016 to require that each special district have the right to work directly with the URA and developer before participating in the URA.

- Additionally, the developers in Pagosa have begun meeting with special district representatives to ensure that any potential costs of providing service to the project by the special districts are accounted for, and that each taxing entity agreement results in a positive impact for all special districts.

- There’s no “blight” on this property.

- Rather than leave the meaning of “blight” open for individual interpretation, state law provides a very specific definition of blight in the context of Urban Renewal. The condition survey completed on the property in Pagosa Springs [View HERE] provides background on the law, the definition of blight and the findings relating to the subject property. As the study shows, the property clearly qualifies under the law due to lack of infrastructure and health & safety issues, among other things.

Best Practices

Both advocates and opponents of TIF agree that successful TIF and URA projects should have these characteristics:

- Achieve public goals and have a lasting positive impact on the community

- Encourage development in the right areas

- Be a transparent and accountable public-private partnership

- Have community support and buy-in

As a community we can and should continue working together to ensure the project and URA accomplish the above objectives.

Examples of Projects – TIF and Urban Renewal Project Areas

- Stapleton, Denver

- 16th Street Mall, downtown Denver

- Leadville

- Durango (forming URA now)

- Bel-Mar, Lakewood

- UC Village, Colorado Springs

- Montrose

- Fountain

- Trinidad

- Frederick

- La Junta

- Delta

- Firestone

- Erie

- Sterling

- Dillon

- Vail

- Lamar

- Ft. Lupton

- Superior

- Commerce City

- Colorado Springs

- Thornton

Additional Questions?

Please submit your questions and comments in the form below and we will work to answer them on this site. Also, please submit your contact information through the form below to receive updates on upcoming public meetings relating to the Pagosa URA.